Key Takeaways

- Introduction of ASU 2024-01: FASB released ASU 2024-01 to enhance clarity and provide detailed examples for the application of profits interest under ASC 718.

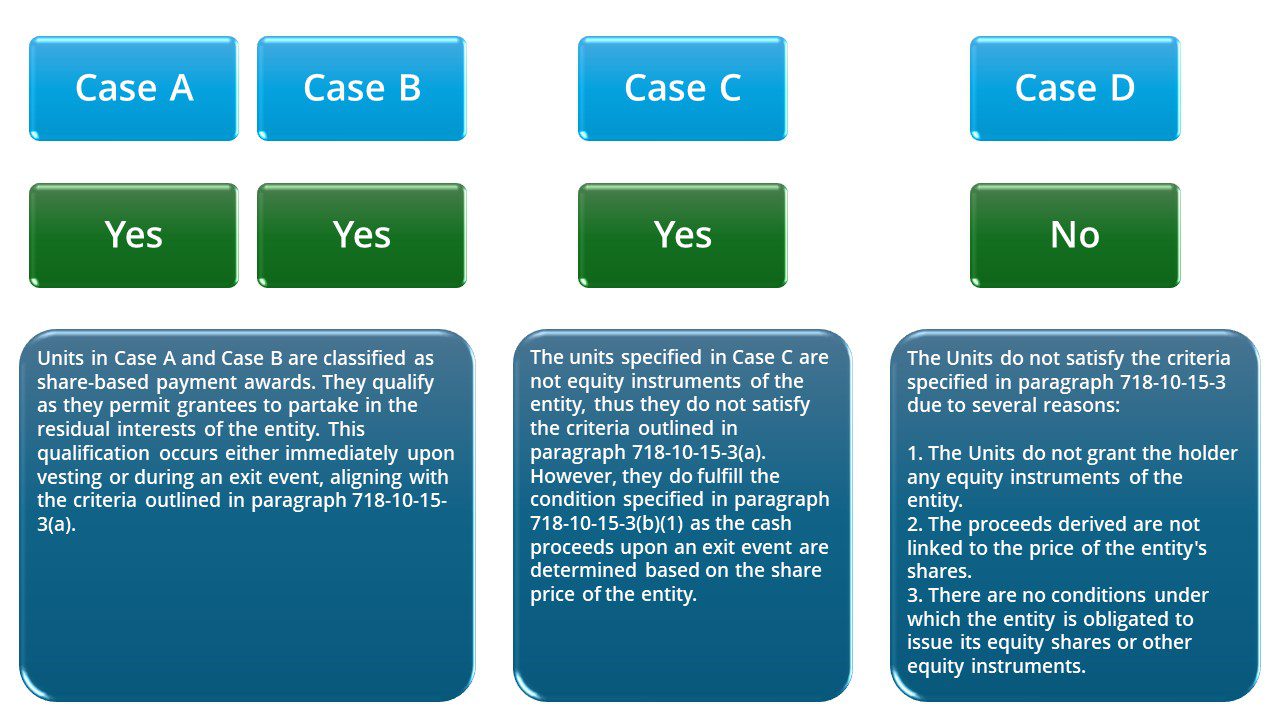

- Expanded Illustrative Guidance: The update includes a new illustrative example that clarifies the scoping guidance for profits interest, helping entities accurately apply ASC 718.

- Detailed Definition and Application: Reinforces the definition of profits interest via IRS Revenue Procedure 93-27 and outlines its accounting implications under various scenarios within ASC 718 and 710.