Business entities with significant R&D budgets should be prepared for tax law changes effective in 2022.

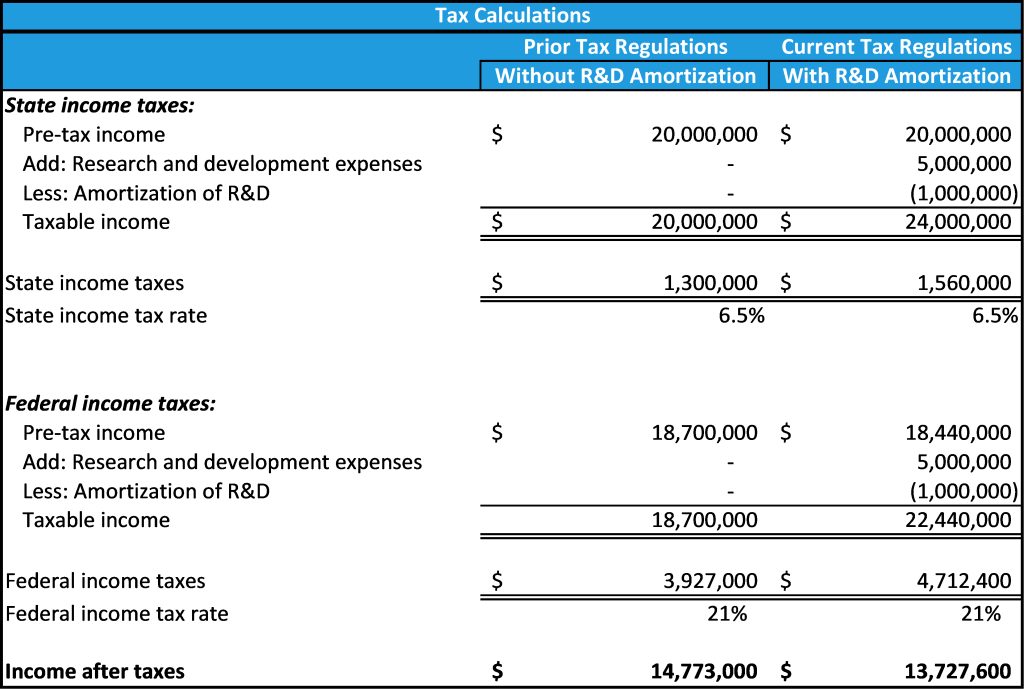

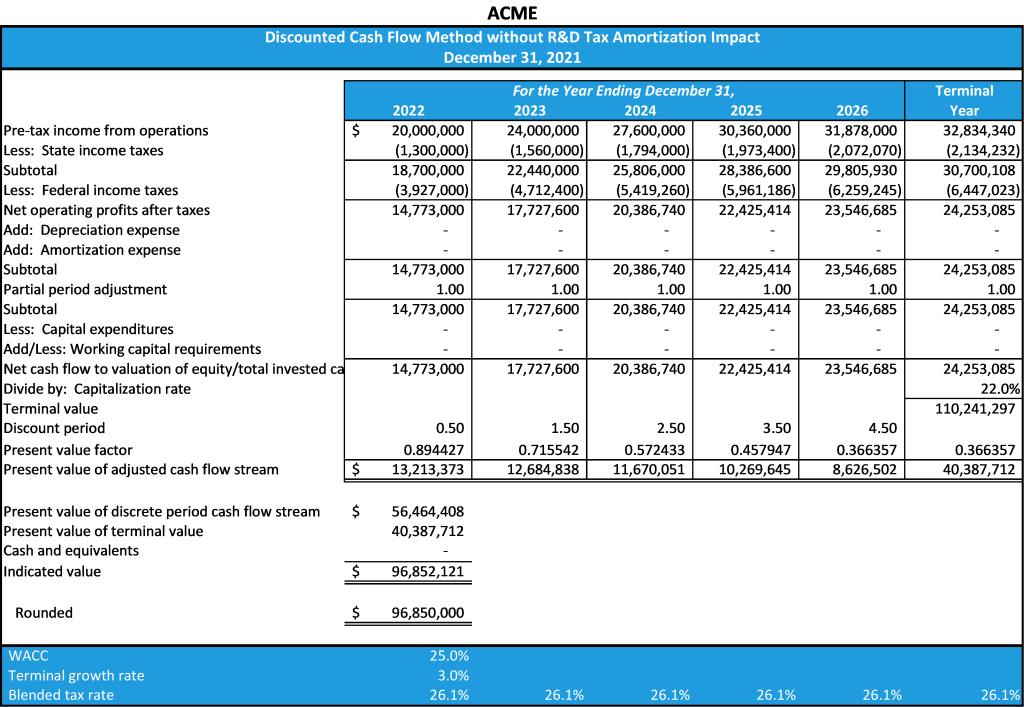

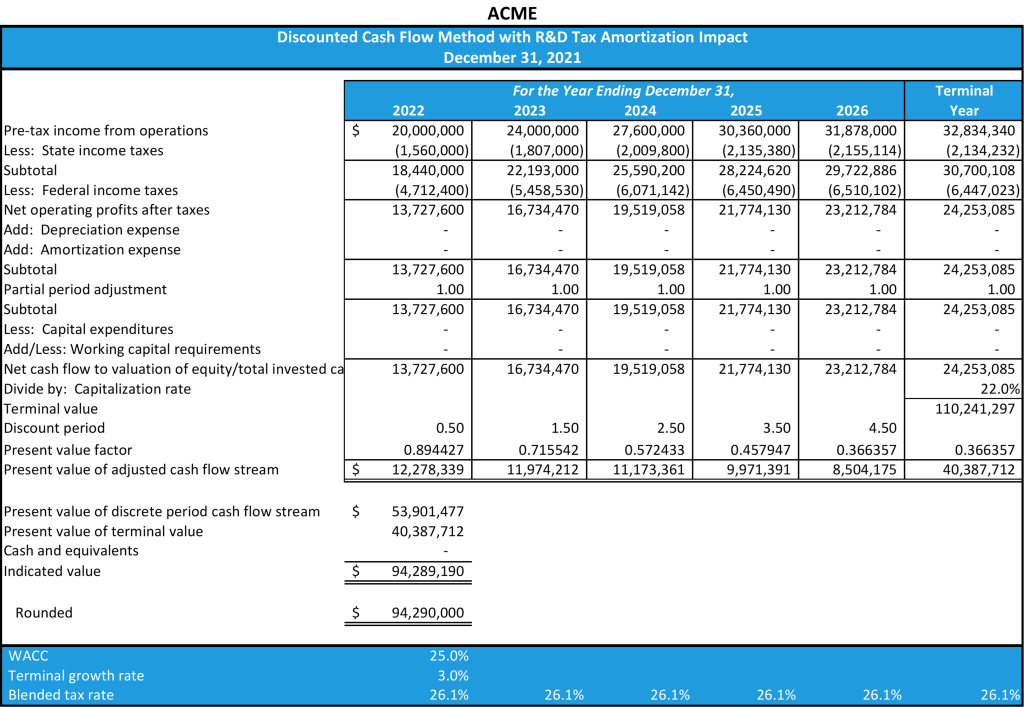

Although the Tax Cuts and Jobs Act (TCJA) was signed into law in December 2017, several provisions did not take effect for several years. Among them are significant changes around the treatment of research and development (R&D) expenses. Before 2022, businesses were permitted to fully expense the costs of R&D. However, effective Jan. 1, 2022, those expenses may no longer be eligible for an immediate deduction but are to be amortized over five years (for domestic R&D) or even 15 years (for foreign R&D spend)[1]. These amortization requirements increase taxable income and thereby reduce cash flow. The cash flow impact can be significant, especially for Software as a Service (SaaS), technology, life sciences and other companies that conduct a significant amount of R&D. The tax bite will be even bigger for those business entities with significant R&D spend outside the U.S.