Do you know the state income tax implications of the investments you are making? State income tax filing requirements cannot be ignored, especially when revenue-hungry states have been paying close attention to who may not be filing whre required. Most taxpayers are not fully aware of the state income tax consequences that come along when they begin investing, working, or operating their company in multiple states. This article summarizes some key items you need to know about state income tax filing requirements for individuals in their capacity as an investor.

What triggers a state income tax filing requirement?

Taxpayers are usually familiar with income tax requirements for their home state. Are there other states where they should consider filing?

If a taxpayer invests in a flow-through entity, is the beneficiary of a trust, or owns rental property located in another state, they may be subject to state income taxes in that state. If they are reporting income from these sources on their personal federal income tax return, then they may be subject to state income tax reporting for that same income.

Ownership of stock in a corporation normally does not generate a state filing requirement for the owner, since corporations are not pass-through entities. The most common investments we see causing a new state filing requirement are from pass-through entities, trusts, or rental real estate that generate income or losses sourced to an activity that operates in another state.

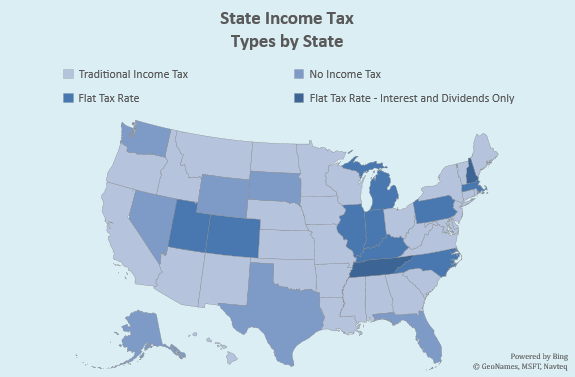

Typically, state income taxes fall into one of three categories:

- Traditional State Income Tax – Most states fall in this category, which is based on a progressive tax system. This means that the more income you have in a given year, the higher the percentage of taxes you will pay at the state level.

- Flat State Income Tax – Some states currently use what is known as a flat tax system. You pay the same percentage in taxes no matter how high your income is.

- No State Income Tax – There are nine states that do not have an income tax on earned income. However, Tennessee and New Hampshire (which are typically included in this list) do have a tax on certain interest and dividends. The Tennessee tax is being phased out and will be completely repealed as of January 1, 2021.

Should I file in a state other than my home state?

The important thing to know when it comes to state income tax compliance is that every state has different requirements and must be looked at individually. There is not a one-size-fits-all approach to take, as each taxpayer’s situation is unique.

Here are a few items to consider when deciding whether to file in a particular state:

- Determine if you have a state filing requirement under that state’s tax law. Your tax advisor should be able to evaluate this for you based on your investment activity and tax documentation, such as K-1’s or 1099’s.

- Many states have rules regarding passive activity losses. Like the federal rules, they limit passive investors from fully deducting losses to the extent of passive income. This can further complicate the decision process because taxpayers cannot simply net their income and losses to make the determination to file in that state.

- Materiality can also play a factor in a taxpayer’s decision to file in another state. When an underlying investment is generating a nominal amount of state sourced taxable income or loss, some taxpayers decide to not file in that state because of the increased cost of filing additional state tax returns.

- Understand the consequences of not filing required state income tax returns. If the state finds that you did not file a tax return when required, penalties and interest from failure to file can be quite high.

- Some taxpayers immediately decide to not file a state tax return if they are generating losses in that state, but this is not always the best answer. If the particular state allows unused losses to carry forward to future years, the taxpayer should still consider filing in that state and building up their loss carryovers, so that they may offset future income in that state or gain on the sale of the investment that is in that state.

- While we focus on investment income in this article, make sure you consider other kinds of income when going through this thought process. For example, a taxpayer who has a sole proprietorship that operates in other states or who travels to other states as an employee or to perform director duties for which they receive director fees should consider these types of income potentially sourced to other states as well.

- Even if there is a state filing where a taxpayer might have passed on filing the past few years, you should take a fresh look each year and consider filing.

Options to ease the state tax burden for taxpayers

There are some ways to mitigate the burden of state income tax compliance for individual taxpayers who have a filing requirement due to their investment in a pass-through entity, such as a partnership.

One option is for the pass-through entity to file a composite tax return where allowed. This tax return is filed by the entity, with the entity paying for the individual owner’s share of state income tax for that activity. If an individual has ownership in more than one entity in that state, all their entities with activity in that state would generally need to file composite state tax returns to fully alleviate the income tax filing requirement of the individual in that state. One downfall to composite tax returns is that the income is generally taxed at the highest individual tax rate rather than a potentially lower tax rate if the individual filed a separate state tax return.

Another option is for the entity to file a withholding tax return with the state. The entity withholds and remits the tax to the state that is then considered a credit towards the taxpayer’s state income tax, similar to federal withholding shown on a W-2. The state income tax filing requirement of the taxpayer is not alleviated in this case; however, the taxpayer may then claim the withholding as a credit on their state income tax return and write a smaller check to the state (or get a refund of tax) when they do eventually file the state tax return.

Conclusion

New state income tax filing requirements can be the outcome of making certain investments and should not be ignored, especially as states are getting more aggressive in enforcing their filing requirements. The decision process around filing state tax returns can be very complex, as there are many factors to consider and each taxpayer’s situation is unique. The Wealth Advisors team at LBMC can guide you through this complex decision process.

Executive Summary

- State income tax filing requirements commonly arise from investments in pass-through entities or rental real estate.

- Composite returns and withholding taxes filed at the pass-through entity level will often simplify and reduce the burden on the individual taxpayer.

- Start the discussion with your tax advisor now if you feel like you have state income tax factors to consider or would like to better understand your state income tax situation.

Content provided by LBMC tax professional April Mitchell.

LBMC tax tips are provided as an informational and educational service for clients and friends of the firm. The communication is high-level and should not be considered as legal or tax advice to take any specific action. Individuals should consult with their personal tax or legal advisors before making any tax or legal-related decisions. In addition, the information and data presented are based on sources believed to be reliable, but we do not guarantee their accuracy or completeness. The information is current as of the date indicated and is subject to change without notice.