Knoxville Tax Services

As Tennessee’s premiere accounting experts, we pride ourselves on picking up where other firms leave off. We offer the same level of national expertise and experience as the biggest firms in the country, but with unexpected accessibility. We prioritize service and responsiveness in a way characteristic of a much smaller firm, but backed by deep industry knowledge. That’s because with LBMC, you don’t have to choose between quality and warmth — you get the best of both worlds.

We tailor our audit approach to the needs and characteristics of each client and invest time to become familiar with each client’s business and accounting systems.

| Preparation & Planning: LBMC’s service model begins with detailed planning and agreed to timelines to ensure that deadlines and expectations are met. LBMC commits to meeting with our clients on a monthly or quarterly basis. |

| Collaboration: The LBMC tax team partners with you as an extension of your own internal resources, acting as not merely a service team, but as an advisor to the operation of your enterprise or family. |

| Responsiveness: As an extension of your internal resources, the LBMC tax teams are committed to providing timely and accurate solutions and are able to pivot quickly to meet the needs of your business or family. |

Knoxville CPAs and Accountants

As the top Tennessee-based CPA firm, we believe our Knoxville accountants have the knowledge, qualifications, and expertise to offer the highest level of service available at a superior value. If you desire an accounting firm that has an experienced and responsive service team skilled in tax compliance and tax transactional structuring, and experience working with complex businesses with multi-state operations, then LBMC is the firm for you.

Federal Business

We will work closely with you to understand your business operations and identify tax issues and strategies necessary to meet your business goals. The complexity of income tax laws offers many opportunities for tax savings or tax deferrals. Because it is your right to employ every legitimate means to reduce your tax liability, we focus our tax services on insightful and timely tax planning advice.

State and Local

State and Local Tax needs are constant, recurring events. The impact of state taxation on businesses is complicated. Managing risk and identifying opportunities within state and local tax laws can be overwhelming. This evolving area of the law has created uncertainty on all sides regarding when you are taxable, how much income is taxable, or what is and is not taxable. On the bright side, complexity creates opportunity.

International Tax

Multinational companies and those considering expansion overseas face a growing number of international tax planning and compliance challenges. It can be nearly impossible to keep up with all the changing regulatory, legislative and tax requirements. Multinational businesses in real estate investment, distribution and manufacturing, technology and many other sectors can turn to our experienced team.

Individual

Historically, wealth was largely passed down from generation to generation. However, today we see wealth created in many ways and an increased need for professional assistance in the management of complex financial affairs for wealthy individuals, corporate executives and families. The LBMC Wealth Advisors team has significant experience in accounting & tax services, estate and trust matters, executive compensation planning, investment services, philanthropic issues, and insurance and retirement planning.

Credits & Incentives

To attract and retain growing businesses, state and local governments provide valuable economic incentives such as grants, tax credits, abatements and more. When your company expands, makes capital investments or adds new jobs, LBMC in partnership with McGuire Sponsel will guide you through the economic incentives process. Whether your company is opening a new location, relocating or expanding an existing facility, the LBMC/McGuire Sponsel team can drive value from investment and growth.

Preparation of Tax Returns

Our tax services include the preparation of federal, state and local tax returns for corporations, partnerships, individuals, private equity funded organizations, employee benefit plans, estates and trusts. Virtually all tax returns are prepared using what we consider to be the best available technology, allowing for increased accuracy and reduced turnaround time.

Tax Planning & Advisory

If your business is growing, consolidating, relocating or expanding facilities, merging or acquiring, there may be significant opportunities for state and federal tax savings. LBMC’s experienced specialty tax team can help you uncover, identify, qualify, comply and realize the benefits of tax credits, research and development incentives for your business activities.

Featured Blog Posts

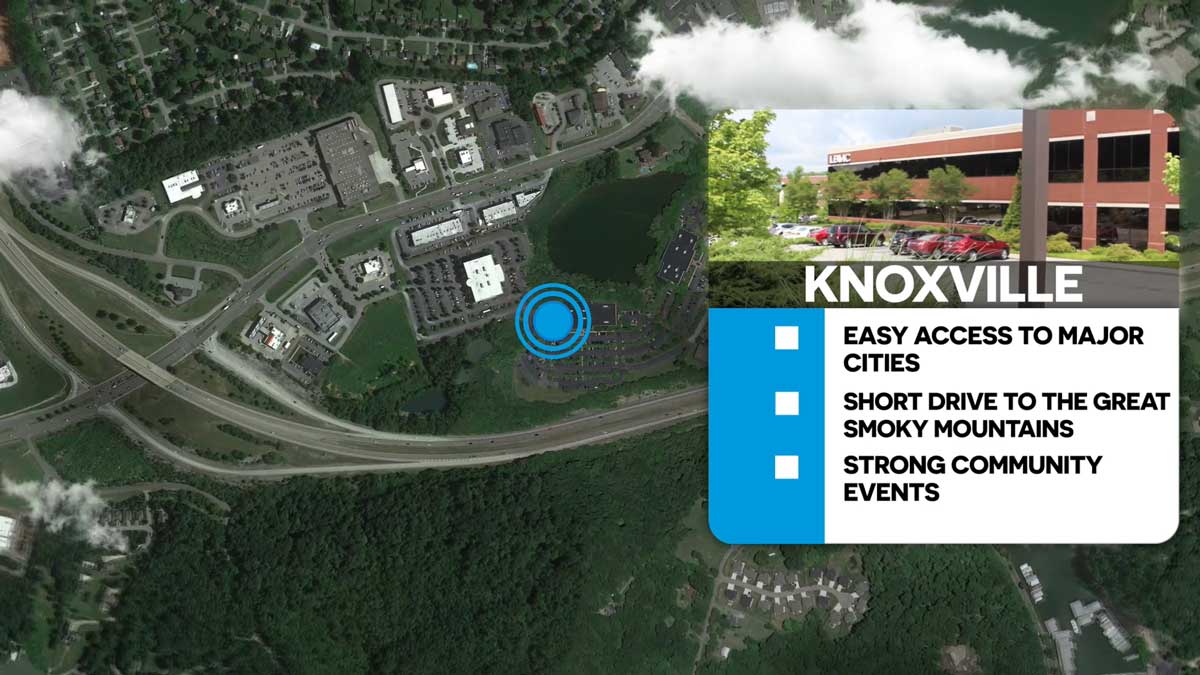

Knoxville is a great place to live and play.

Ranked #57 on Livability’s 2019 Top 100 Best Places to Live, Knoxville has easy access to major cities, a short drive to the Great Smoky Mountains and strong community events. Sports enthusiasts will enjoy the minor league baseball Tennessee Smokies, the Knoxville Ice Bears professional hockey team, the female roller derby team Hard Knox Roller girls and home to The University of Tennessee Volunteer football and basketball teams.

Knoxville is a great place to work.

The LBMC Knoxville team is located in a modern workspace, with plenty of natural lighting and enhanced technological innovations. It is located a few miles west of Knoxville, TN, a city ranked in the Top 150 for Best Places for Business and Careers by Forbes magazine, as well as Best Places to Live by U.S. News.

For more information on working and living in Knoxville, visit the Knoxville Chamber of Commerce. and check out our LBMC careers.

What services are offered at the Knoxville office?

Our Knoxville team works in a variety of industries including manufacturing and distribution, construction, real estate, not-for-profit, and healthcare, just to name a few. We have CPAs and licensed professionals in tax, audit, business valuation, litigation support, healthcare consulting and compliance, risk services, human resources, recruiting and more. We can support all LBMC services in this office. See our services list for more information.

LBMC’s Team of Knoxville Tax CPAs and Advisors

Knoxville

Contact

Location:

2095 Lakeside Centre Way

Suite 220

Knoxville, TN 37922

Mailing Address:

2095 Lakeside Centre Way

Knoxville, TN 37922

Phone: 865-691-9000

Office Hours: 8 am – 5 pm EST, Monday-Friday

- Sales representative or vendor, click here.

- Employment verification or references, click here.

- Need a W-9 form, click here.

- Applying for a job? Visit our Current Job List and apply for the jobs that interest you.

Complete this form to have an LBMC expert contact you.