Benefits Brokering & Administration

As a team of licensed brokers, LBMC Employment Partners offers top-to-bottom employee benefits brokering services. Through our full-service brokering options, we can provide companies with access to the most competitive benefits package rates available. Our team eases the burden of benefit selection, enrollment, education, compliance, and administration, allowing you to focus on running your business.

Additionally, our full-service approach to your employees’ well-being includes facilitating the navigation, management, development, and implementation of a customized wellness program. Even better, our payroll clients who also receive benefits brokering enjoy seamless integration between payroll and benefits activity.

Client Testimonials

LBMC EP’s Benefits Brokering Services include:

- Negotiation of Contract Variables & Rates

- Contract review of all plans proposed

- Comparison of rates to current and proposed group products

- Identify key components affecting rate increase/compare to market and current plans

- Review utilization data

- Reconciliation of Billing Statements from all Benefit Providers

- Assist with reconciliation of group products

- Provide reconciled statement

- Address issues impacting enrollment and/or collection of premium

- Administration and Communication of all Benefit Plans

- Employee Benefit Advocacy Service for all Eligible Participants

- COBRA Administration

- Limited access to Employee Navigator, our online enrollment tool

When it comes to employee benefits brokering, are you ready to say goodbye to multi-vendor relationships and hello to an efficient, cost-effective approach to running your business and securing competitive benefits package rates for your employees?

How to Choose the Best Employee Benefits Broker for Your Business

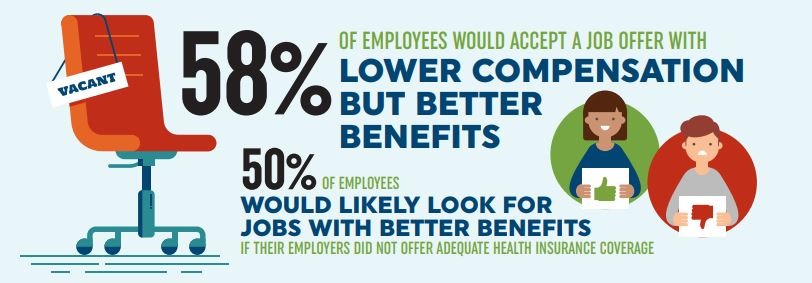

Offering great benefits can give an employer a competitive edge over other companies seeking to attract top talent. But, before landing the perfect benefits package, companies first must find the right employee benefits broker.

Benefits are likely to be one of a company’s largest expenses aside from payroll and finding the right representative to manage that money is no small task.

Here are some tips for choosing the best employee benefits broker for your business:

- Start early. The best time to start the hiring process for a new employee benefits broker is right after renewal, when all the challenges from negotiating last year’s benefits package are still fresh. At the very least, companies should start the search for their employee benefits broker six months ahead of open enrollment.

- Build a large pool of candidates. There’s no shortage of employee benefits brokers, and companies shouldn’t limit themselves when scanning the field for options. By talking to several different brokers, employers can learn more about what services are out there and what may benefit their company.

- Ask for recommendations. It’s easy to find a list of brokers using the Society for Human Resources Management (SHRM), but it’s much better to ask around for recommendations. Other business owners, HR managers, or board members are a good place to start when looking for a great recommendation.

- Be thoughtful with the questionnaire. If your company chooses to go through an RFP or questionnaire process, choose questions that are tailored to the company’s specific needs. In addition to asking about the benefits themselves, companies should ask brokers about their customer service, fees, and other services.

- Every company is different. Location matters. If you are a Tennessee-based company, you should have a Tennessee-based employee benefits broker. Other considerations include company size and growth potential.

Eight Expectations of a Benefits Broker

- The broker should communicate and educate the client on their benefit offerings, as well as assist with the enrollment process for members.

- The broker should act as a liaison for Wellness and Risk Management activities, as well as establish a relationship with applicable vendors.

- The broker should provide Advocacy Services that assist all benefit-eligible and benefit-enrolled members with explanations of benefits, explanation of E.O.B.’s, provide support for members with claims issues, offer prescription assistance, and provide plan provisions and provider assistance.

- The broker should offer COBRA and 125 plan administration, including COBRA notices and reconciliation of premiums received (at a separate fee).

- The broker should assist in reconciliation of billing statements from all benefit providers.

- The broker should market, review, analyze, and propose plans at renewal.

- The broker should be knowledgeable and work with vendors to help ensure compliance with PPACA.

- The broker should provide access to an online benefits enrollment tool.

Need Employee Benefits Brokering Services?

As a full-service broker, LBMC Employment Partners can provide companies with access to the most competitive benefits package rates available. Our full-service approach takes the burden of benefit selection, enrollment, education, compliance and administration from our clients allowing them to focus on their business.

In case you weren’t aware of the full palette of services available from LBMC Employment Partners, here’s a breakdown of our brokering services to provide some clarity.

- Shop and quote medical, dental, vision, LTD, STD, Life, various supplemental and voluntary products

- Ongoing relationship with major benefit carriers

- Client plan offerings and enrollment education

- Online enrollment platform at no additional cost

Plan Design

- Provide design strategies to help meet coverage and financial goals

- ACA Compliance

- Coordination of other benefits, including HSA, FSA, and HRA accounts

Administration

- Client will have a dedicated Account Manager

- Liaison between client and benefit carriers

- Day-to-day maintenance and back office administration

- Monthly premium invoice reconciliations for all coverages

- Participant advocacy and claim assistance at no additional cost

- COBRA administration, including the collection of payments at no additional cost

- Form 5500 preparation

- Plan document preparation

Clients who also use LBMC EP’s payroll services will enjoy a seamless integration between payroll and benefits activity.

Featured Blog Posts

All content and services on this page are offered by LBMC Employment Partners, LLC. LBMC Employment Partners, LLC, is part of the LBMC Family of Companies and is an independent entity with services and products being provided exclusively by LBMC Employment Partners, LLC.