If you are a business owner in 2026, you’re probably experiencing economic pressure and opportunity at the same time. Growth is slower. Costs pare up. Trade and policy shifts are hard to predict. Meanwhile, customers and employees expect fast, more digital experiences.

Despite these challenges, companies pulling ahead will be the ones that stay disciplined and modernize on purpose, especially around AI-powered tools, cybersecurity, digital infrastructure, and core systems. In fact, global digital transformation spending is projected to reach $3.4 trillion by 2026, and information security spending is expected to exceed $240 billion, indicating strong modernization momentum even as consumer spending cools. (College of LSA)

What’s really changed is not just the economy. It’s how trust is built. Banks, investors, customers, and regulators now rely on digital systems, data, and controls to decide who they will do business with. In 2026, companies don’t just need to perform well — you need to be provably trustworthy.

The questions are simple: Where do we place our bets? What do we delay? And what can’t we afford to ignore? This U.S. business outlook highlights the trends shaping strategy for middle market and small business leaders, and what they mean for business investment decisions, risk management, and long-term planning. Across all of these trends, one theme is constant: businesses that can demonstrate financial, operational, and digital trust will have easier access to capital, customers, and growth.

1. Macroeconomic Conditions: Slower Growth, Persistent Cost Pressure

Why It Matters

Macroeconomic conditions shape decisions about hiring, pricing, and liquidity. Companies are managing slower growth, persistent inflation, and elevated interest rates. The Federal Reserve is balancing inflation trends against the unemployment rate, creating uncertainty for the labor market and business investment.

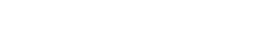

Figure 1: Macroeconomic Snapshot: GDP Growth and Inflation

Moderate growth continues as inflation trends lower

Source: College of USA

What We’re Seeing

- U.S. GDP is forecast to grow 2.2% in 2026. (College of LSA)

- Inflation and supply chain pressure continue to raise operating costs. (The Economic Times)

- Tariff-related import costs affect companies relying on global sourcing. (TD Economics)

- Business investment is increasing due to spending on AI tools and productivity initiatives. (Deloitte)

What This Means for You

Evaluate multiple scenarios for sales, cash flow, and working capital. Consider how rate cuts or extended high rates may affect capital projects. Investments that improve efficiency and support long term resilience will matter most.

LBMC Insight

“When macro conditions tighten, prudent forecasting and liquidity planning become a competitive edge. We help clients build scenario-based forecasts to stay ahead of disruption.” — Laura McGregor, LBMC Audit & Advisory

“While taxes were largely settled by last year’s legislation, monetary policy has become a much bigger issue in early 2026. The Federal Reserve OMC appears truly divided on interest rates, making it much more difficult to predict the direction of the credit market moving forward.” — David Frederick, LBMC Tax Structures and Strategies

2. Tax & Regulatory Shifts: OBBBA, Trade Policy and Compliance Complexity

Why It Matters

New federal tax rules offer some needed clarity and consistency but shifting global trade policies are increasing complexity. Revised rules in small business deductions, depreciation, expensing, and transfer taxes have generally worked to the advantage of businesses, succession planning, and after-tax returns.

Recent tax and trade changes affect investment timing, capital limits, and input costs.

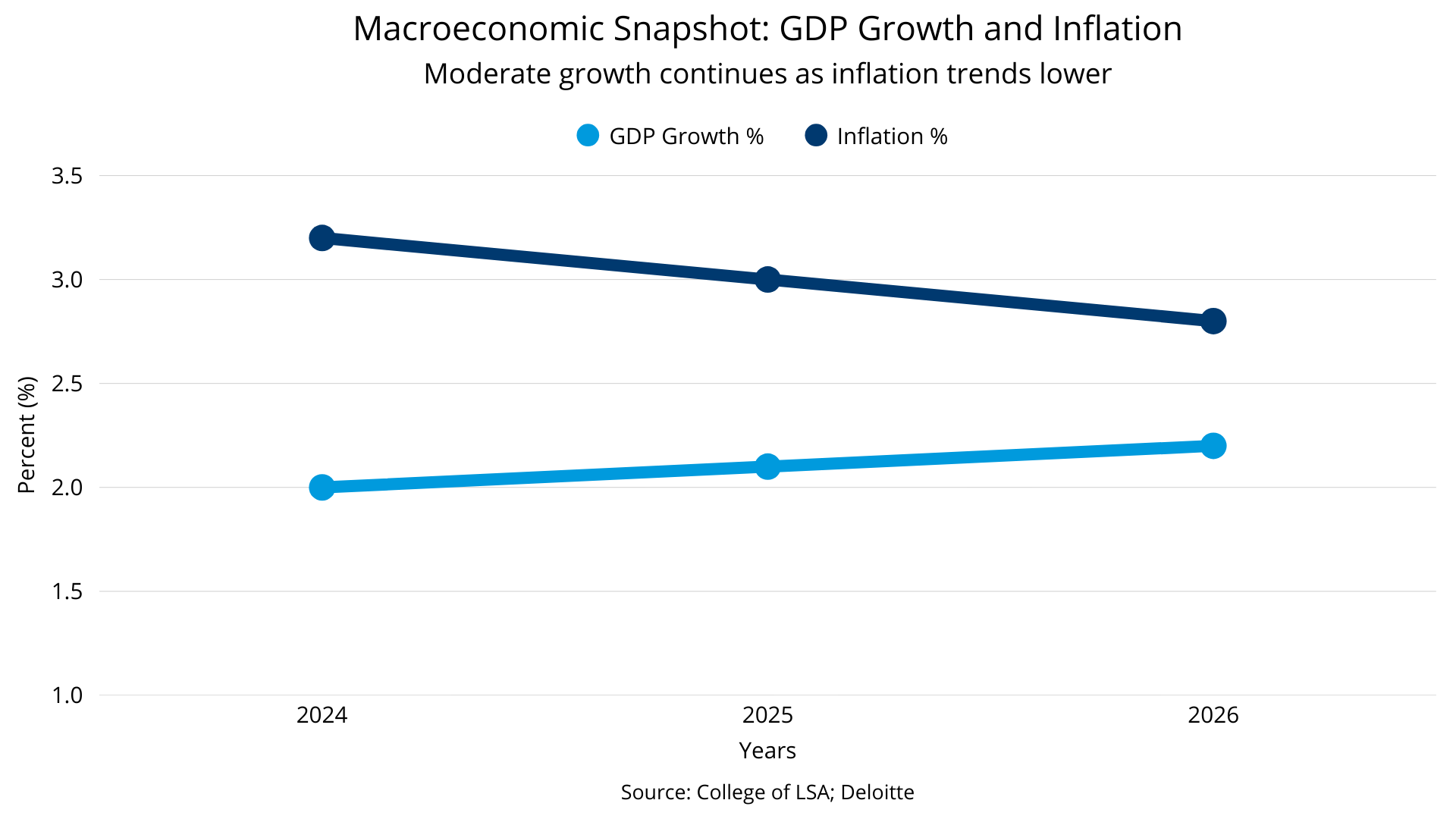

Figure 2a: Bonus Depreciation Expansion Under OBBBA

Full expensing accelerates cash-flow recovery

Source: Moss Adams

What We’re Seeing

- OBBBA changed depreciation, expenses, and corporate tax rules. (IRS)

- Higher tariffs continue to increase import costs for global suppliers. (Capital Analytics Associates)

- State nexus rules and sourcing thresholds remain in flux.

- Regulatory enforcement and reporting expectations continue to rise.

What This Means for You

Update tax models regularly, especially when planning capital investments. Strong governance, accurate reporting, and proactive planning help companies reduce audit risk and strengthen lender confidence.

LBMC Insight

“Strategic tax planning and entity structuring matter now more than ever. Companies that anticipate and plan for policy shifts outperform reactive competitors.” — Matt Wallace, LBMC Tax Services

3. Supply Chain Reconfiguration & Nearshoring Momentum

Why It Matters

Tariff volatility and global disruptions are driving companies to diversify sourcing and nearshore to reduce risk. Stronger visibility and faster response help businesses keep pace with changing consumer behavior.

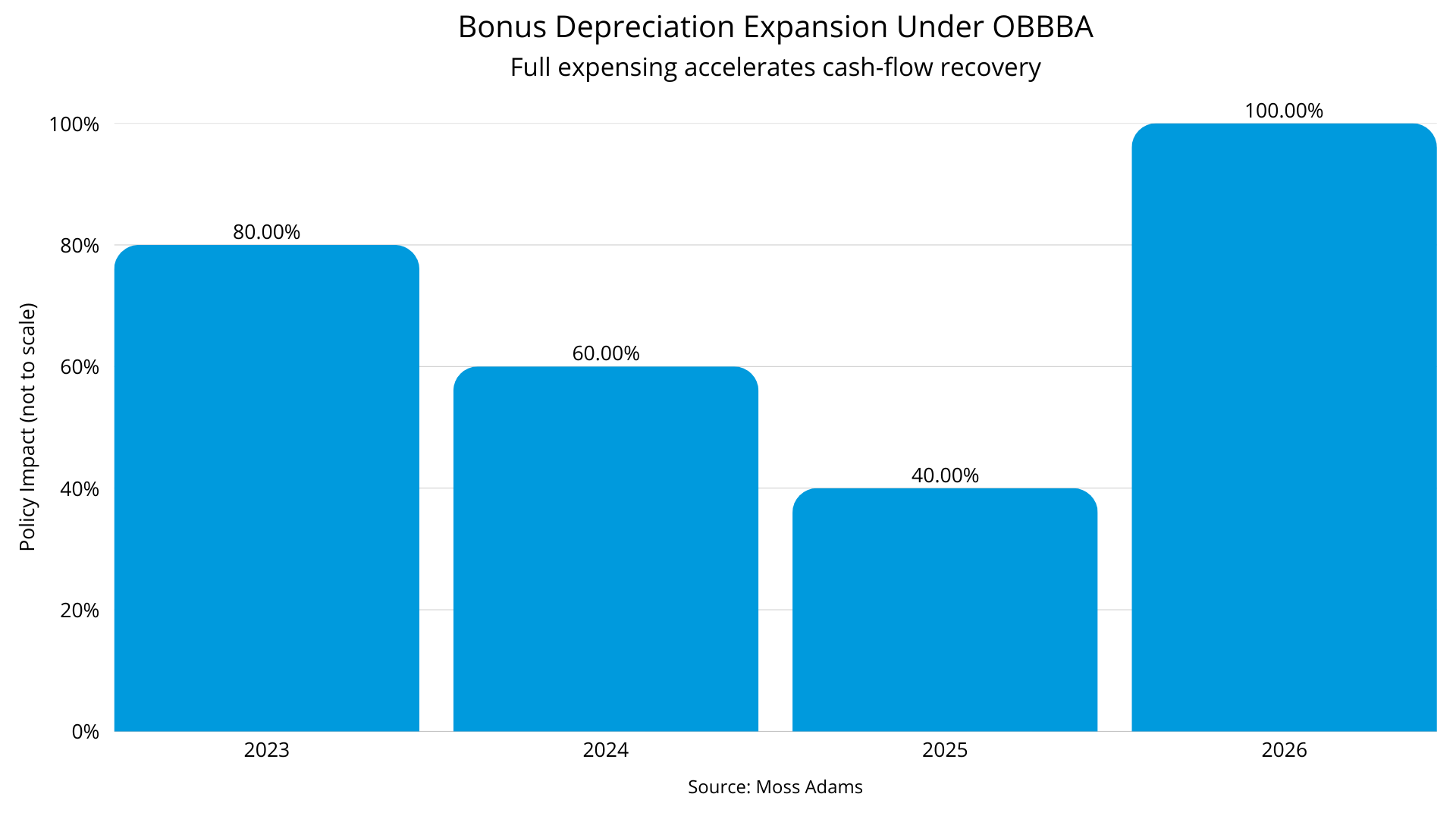

Figure 3: Global IoT market forecast (in billions of connected IoT devices)

Source: IoT Analytics

What We’re Seeing

- Global growth in Internet of Things (“IoT”) devices, or physical objects connected to the internet, are projected to exceed $21.1 billion by 2025, as more physical objects such as smart TVs and refrigerators become connected to each other and the internet. (IoT Analytics)

- Cellular IoT connections will reach $8 billion by 2030, expanding automation. (Ericsson )

- Companies are shifting sourcing away from high-tariff regions and toward nearshoring. (TD Economics)

What This Means for You

Review sourcing models, vendor exposure, and inventory planning. Multi-sourcing, nearshoring, and investment in IoT tracking improve resilience and protect margins when demand or logistics shift.

LBMC Insight

“Supply-chain resilience demands alignment between procurement, tax strategy, and operations. We support clients in designing flexible sourcing models and mapping risk across vendors and geography.” — Matt Wallace, LBMC Tax Services

4. Generative AI & Automation: From Pilot Projects to Core Operations

Why It Matters

Artificial Intelligence (“AI”) is moving into core operations. Generative AI improves forecasting, reporting, document review, and customer experiences. Companies that modernize data and govern AI tools responsibly gain the most value.

What We’re Seeing

- Most companies are still in the experimenting or piloting stages, with almost one-third reporting they have begun to scale their AI programs. (McKinsey)

- 88% of global organizations use AI in at least one business function in 2025. (McKinsey)

- Enterprises are deploying generative AI for coding, analytics, content, and marketing workflows, as well as customer‑facing interactions, with departmental AI spending exceeding $7.3B in 2025. (Menlo)

- Data quality, lineage, and preparation, as well as training‑data controls, remain among the most resource‑intensive aspects of AI initiatives and are now central to AI governance benchmarks. (Kiteworks)

- Regulators are increasingly expecting organizations to maintain evidence‑grade logs, access controls, and audit trails for AI‑enabled processes to demonstrate accountability and compliance. (FINTECH Global)

What This Means for You

Start with targeted, low-risk use cases like reconciliations, reporting automation, demand forecasting, and customer support, but don’t scale until your data governance and documentation are solid.

As AI moves into core operations, governance becomes the difference between experimentation and trust — because lenders, regulators, and partners will want to see how AI decisions are made, where data comes from, and who has access.

In that environment, strong governance, controls, and documentation aren’t just helpful; they’re how you prove your business can be trusted to operate in an AI-driven world. Companies that treat AI as a governed capability, not a standalone tool, will be better positioned as adoption accelerates through 2026.

LBMC Insight

“AI delivers real value when supported by strong data infrastructure. We partner with clients to build governance, data pipelines, and practical AI roadmaps that drive efficiency and compliance.”— Jon Hilton, LBMC Consulting & Business Intelligence

5. Cybersecurity, Privacy and Governance: Rising Threats and Higher Expectations

Why It Matters

Cyber incidents, privacy regulation, and governance expectations continue to increase. Customers and lenders now view cybersecurity maturity as a condition for trust, risk mitigation, and long-term stability.

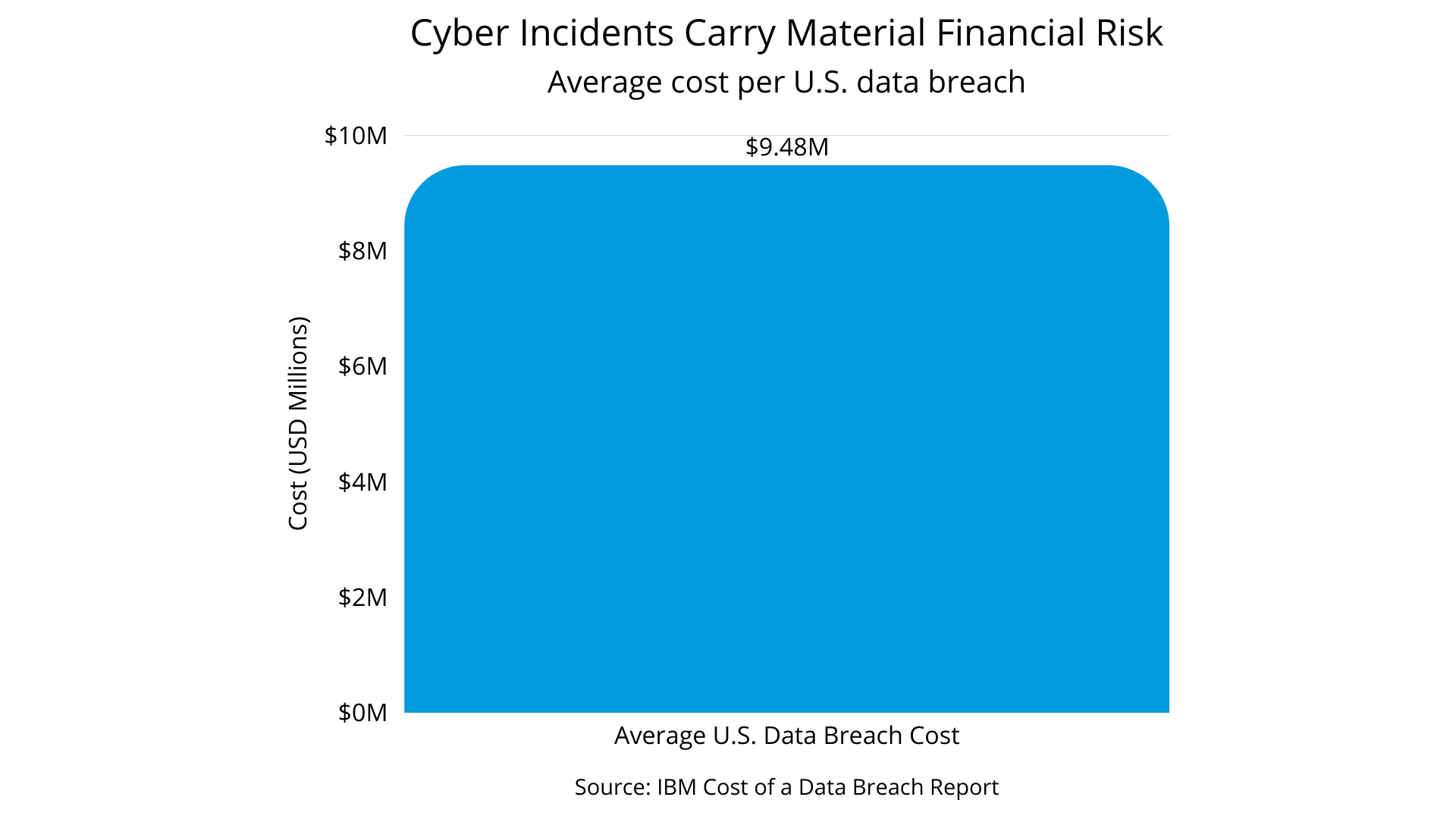

Figure 5a: Cyber Incidents Carry Material Financial Risk

Average cost per U.S. data breach in 2025

Source: IBM

The average U.S. data breach in 2025 cost nearly $9.5M, the highest globally.

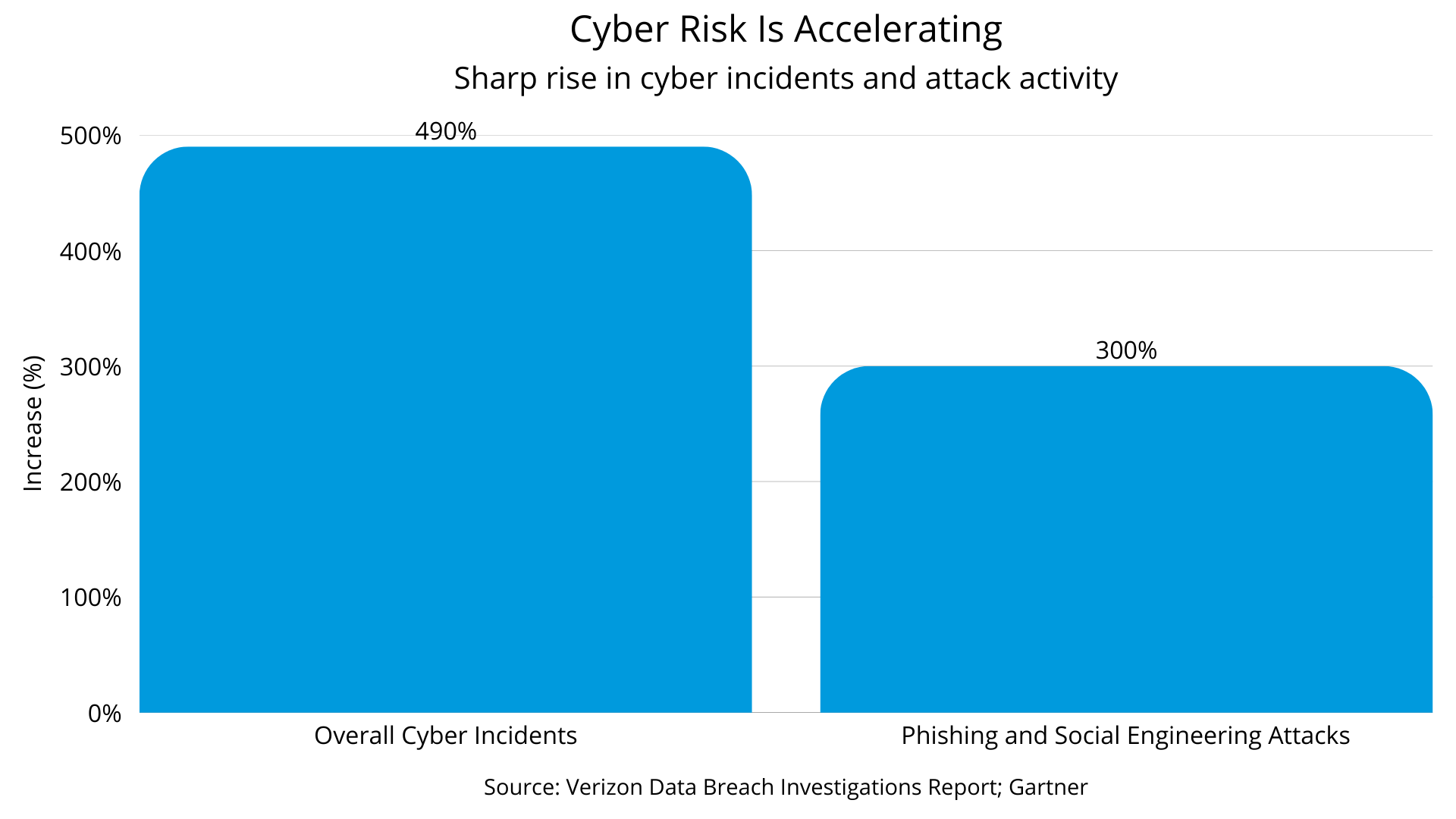

Figure 5b: Cyber Risk Accelerated in 2025

Sharp rise in cyber incidents and attack activity

Source: Verizon Business

300% is a conservative, defensible aggregate based on Verizon DBIR trends without overclaiming.

What We Are Seeing

- Worldwide end‑user spending on information security is estimated to increase 12.5% in 2026 to total $240 billion (Gartner forecast, as reported by Channel Impact).

- More than 170 global privacy laws affect U.S. operations. (IAPP)

- The average U.S. data breach costs $9.48 million. (IBM Cost of a Data Breach Report)

- AI-driven phishing and cyberattacks continue to increase. (Verizon DBIR)

What This Means for You

Unify cybersecurity, privacy, and governance to demonstrate trust. Strengthen identity management, vendor oversight, and documentation so you can show clear accountability, including accurate reporting, entity structure, and audit readiness as core elements of your digital trust profile. Meeting expectations early reduces risk and cost while improving confidence with customers, lenders, and regulators.

LBMC Insight

“Stronger governance builds stronger trust. When cybersecurity, privacy, and reporting operate together, organizations can manage risk with much greater clarity.” — Drew Hendrickson, LBMC Cybersecurity

6. Omnichannel, Mobile Commerce and Consumer Behavior

Why It Matters

Customer expectations are rising. Buyers want fast checkouts, accurate inventory, real time updates, and consistent experiences. Companies must align digital operations with evolving consumer demands and customer loyalty trends.

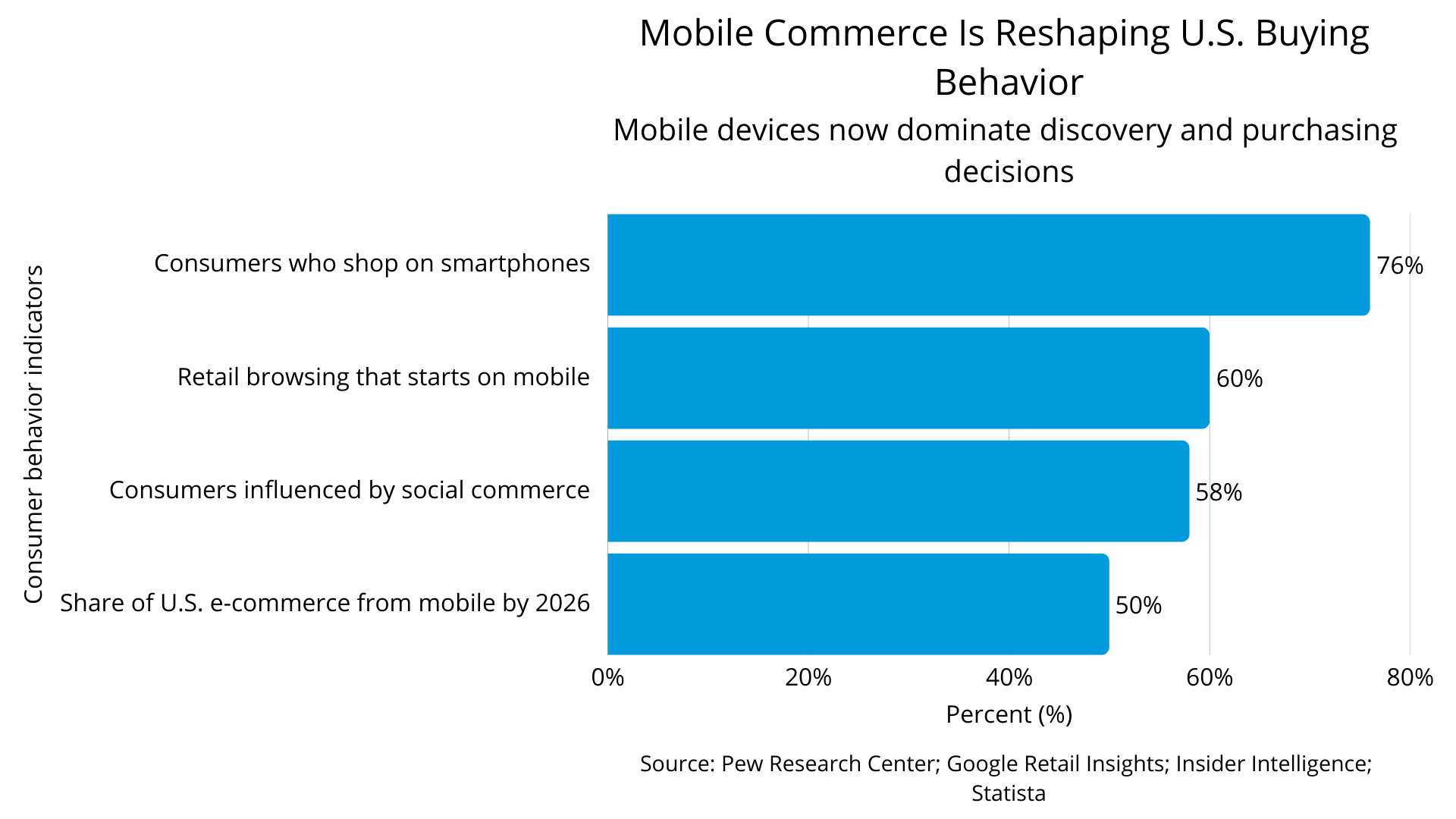

Figure 6: Mobile Commerce Is Reshaping U.S. Buying Behavior

Mobile devices now dominate discovery and purchasing decisions

What We Are Seeing

- Mobile commerce will represent almost 50% of U.S. e-commerce sales by 2026, underscoring a rapidly maturing mobile‑first market. (Red Stag Fulfillment)

- About 75% of U.S. consumers use smartphones to shop. (Capital One Shopping)

- The U.S. social commerce market is projected to exceed $100 billion by 2026. (Statista)

- As of July 2025, more than half of online browsing was reported to begin on mobile devices globally, with mobile driving the majority of shopping journeys. (Exploding Topics)

What This Means for You

Improve checkout speed, management of returns, and inventory accuracy. These steps improve conversion and customer experiences without requiring a full system overhaul.

LBMC Insight

“Companies that connect financial, operational, and customer data behind the scenes are the ones that deliver truly seamless customer experiences.”— Bryan Wilton, LBMC Technology Solutions

7. 5G and Infrastructure Modernization: Powering Real Time Operations

Why It Matters

Modern infrastructure supports real-time analytics, AI adoption, hybrid work, and supply chain visibility. Companies need reliable, secure systems to meet these requirements.

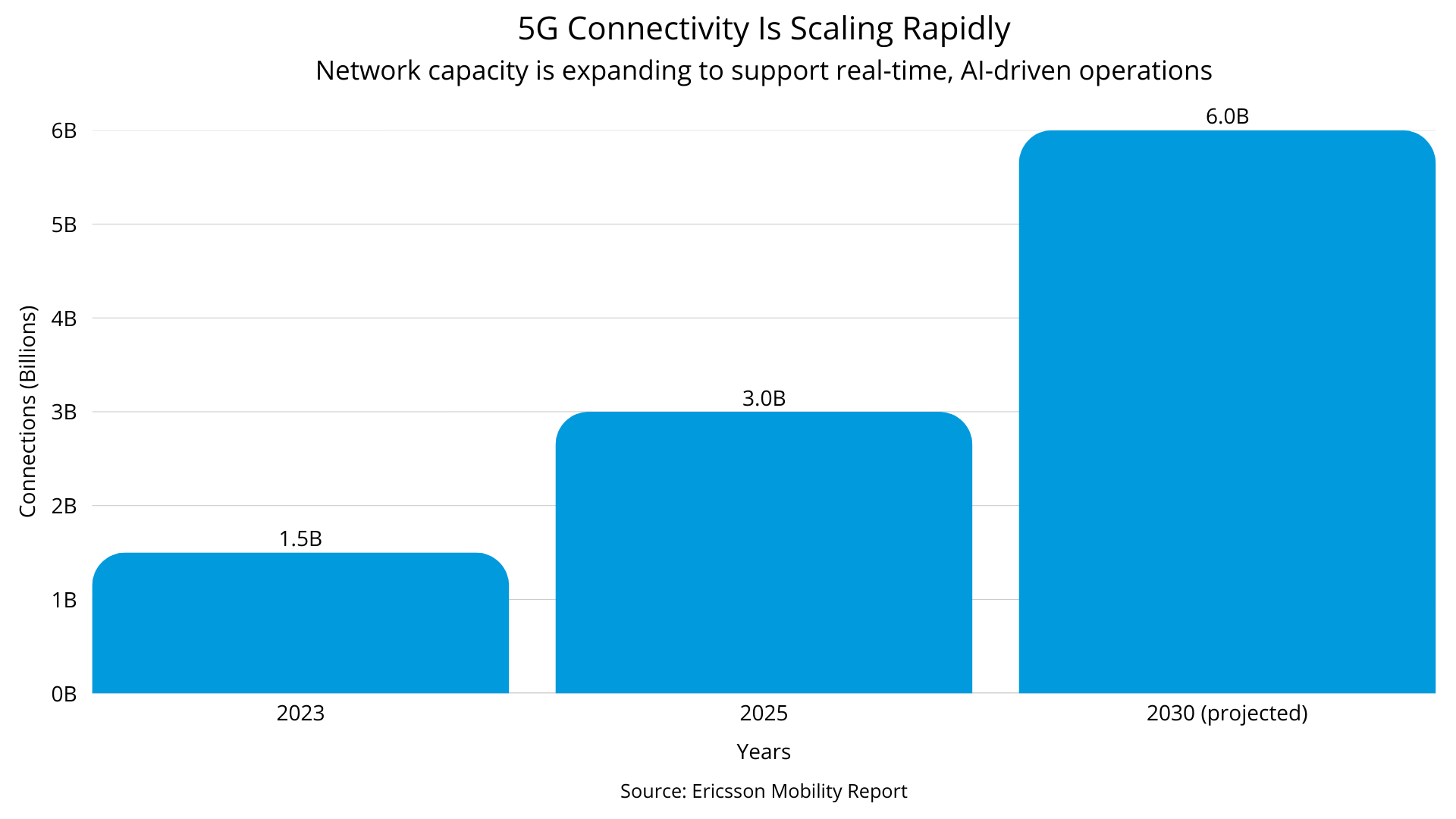

Figure 7: 5G Connectivity Is Scaling Rapidly

Network capacity is expanding to support real-time, AI-driven operations

Source: Ericsson Mobility Report (Nov. 2025)

What We Are Seeing

- North America has 180 million 5G connections, representing more than 55% of mobile connections. (GSMA / Ericsson Mobility Report)

- Global 5G connections will reach nearly 6 billion by 2030. (GSMA / Ericsson Mobility Report)

- IoT devices will exceed 21 billion in 2025 and nearly 40 billion in 2030. (IoT Analytics)

- Companies are increasing investment in edge computing as they build real-time, data-intensive applications on hybrid and private clouds. (Deloitte Tech Trends)

What This Means for You

Evaluate network architecture, device management, and security posture. Infrastructure modernization helps companies support AI tools, remote work, and connected operations.

LBMC Insight

“Infrastructure is the foundation that makes real-time analytics and automation possible. Companies that modernize connectivity and systems see performance gains across the entire organization.” — Bryan Wilton, LBMC Technology Solutions

8. Workforce Gaps and Skills Shortages

Why It Matters

Technology change continues to outpace workforce capability. Skills shortages exist in cybersecurity, cloud, data analysis, and technical accounting. These gaps affect growth, compliance, and long-term performance.

What We Are Seeing

- Approximately 92% of U.S. jobs require digital skills, while one-third of American workers lack these essential skills. (National Skills Coalition)

- The U.S. cybersecurity workforce has around 225,000 unfilled positions. (CyberSeek)

- The average time to hire a technical role range from 44 to 50 days. (LinkedIn Workforce Report)

What This Means for You

Combine internal development with outsourced support and automation. Redesign roles to remove repetitive work and align talent with long term priorities.

LBMC Insight

“Competition for experienced talent remains strong. Companies that invest in transparency, growth opportunities, and employee well-being consistently attract the highest performers.” — Debbie Elliott, LBMC Staffing Solutions

Looking Ahead: Leading With Clarity in 2026

The U.S. business environment in 2026 will reward organizations that balance discipline with selective innovation. Companies that plan for policy shifts, modernize infrastructure, upgrade data quality, strengthen governance, and build workforce capability will be positioned for long term success.

In 2026, the companies that win won’t just be the fastest or the cheapest. They’ll be the most trusted by capital providers, customers, and regulators in a digital-first economy.

LBMC helps organizations build that trust across advisory, technology, tax, audit, and cybersecurity, so leaders can navigate change with clarity and build a stronger foundation for what’s next. We combine deep expertise with a personal, advisor-first approach. If you would like to work with a nationally recognized Top 50 accounting and advisory firm trusted by more than 11,000 businesses across the Southeast, contact us to talk to an advisor.