(Content reviewed by Courtney Bach.)

In 2026, the healthcare organizations pulling ahead are not necessarily the largest, fastest growing, or most technologically ambitious. They are the most operationally intentional.

After years of disruption from workforce shortages and margin compression to rapid digital adoption and shifting reimbursement models, healthcare leaders are entering a new phase. This is no longer a moment defined by transformation for transformation’s sake. 2026 is about execution discipline. The ability to align strategy, compliance, data, and care delivery consistently and at scale has become the true differentiator.

Across provider organizations, private equity–backed platforms, and healthcare-adjacent businesses, leadership teams are being asked harder questions by boards, investors, and regulators alike: Is growth sustainable? Are margins defensible? Can the organization absorb change without disrupting care, culture, or cash flow?

At the same time, patient expectations continue to rise. Access, transparency, digital engagement, and outcomes are now inseparable from financial performance and reputation. Healthcare leaders must balance these demands while navigating regulatory uncertainty, accelerating AI adoption, and preparing for value-based care models that reward precision, not volume.

Healthcare Outlook 2026: From Transformation to Execution Discipline

This Healthcare Outlook for 2026 reflects what LBMC is seeing across the market: organizations moving upstream, addressing readiness, structure, and data integrity earlier—so they can grow with confidence, adapt faster, and create long-term value in an increasingly complex environment.

2026 Tax Considerations Shaping Healthcare Growth & Deal Activity

(Content reviewed by Ben Carver.)

Several 2026 tax changes are already influencing how healthcare organizations are thinking about growth, capital structure, and transaction timing — particularly for privately owned and private equity–backed businesses.

Key areas healthcare leaders are evaluating

- Interest Limitation Deduction Changes

The reimplementation of depreciation and amortization addbacks allows for greater interest deductibility. Combined with expected interest rate reductions heading into 2026, this is improving debt capacity and cash flow modeling—contributing to renewed deal momentum in the healthcare private equity space. - 100% Bonus Depreciation Reinstated

Immediate expensing for qualified assets is strengthening near-term cash flow, especially for healthcare organizations investing in technology, facilities, and equipment. - R&E Expense Deductibility

For healthcare organizations investing heavily in software development, data analytics, and research-driven initiatives, the restoration of deductibility for U.S.-based R&E expenses represents a meaningful cash-flow opportunity. While non-U.S. costs must still be capitalized, this distinction is prompting many organizations to reassess their development models and outsourced partnerships, with increased consideration given to U.S.-based providers from both a tax efficiency and risk management standpoint. - SALT Deductibility for Owners

Expanded deductibility at the owner level may prompt healthcare companies to reassess PTET elections and broader entity structuring strategies. - Qualified Small Business Stock (QSBS) Enhancements

Increased limitations, partial exclusions for companies owned less than five years, and higher qualifying thresholds—most applicable to healthcare-adjacent businesses such as health tech, medical devices, diagnostics, and medical equipment.

LBMC Insight: These tax changes are not occurring in isolation. We are already seeing them influence transaction structures, financing strategies, and long-term planning discussions across the healthcare market. For more information on recent tax changes, read One Big Beautiful Bill Act: Key Tax Changes in 2025.

What We’re Seeing

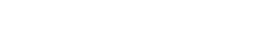

- U.S employer healthcare costs are projected to rise 8% in 2026 even after accounting for new changes in plan design to keep cost in check.

- Healthcare accounts for roughly 17.5–18% of U.S. GDP, making it the largest component of national spending.

- The U.S. health care industry remains one of the nation’s largest employment sectors, with an estimated 19–20 million people employed in 2025 across clinical, administrative, long-term care, and ancillary roles.

- Healthcare employment is forecast growth 8% practitioners/ technical and 15% support from 2022 to 2032, faster than the national average of 3%.

- About 36% of patients delay care due to cost, while 58% of people with health insurance report issues with coverage.

- Facilities offering digital scheduling and real-time communication are seeing higher retention and improved outcomes

What Sophisticated Healthcare Leaders Are Doing Differently in 2026

In our work with healthcare CEOs, CFOs, and boards, a clear shift is underway. The most sophisticated leaders are no longer focused on innovation for their own sake. Instead, they are applying tighter discipline to operations and execution.

Growth-at-all-costs has given way to sharper attention on margin durability, cash predictability, and return on invested capital. Technology investments particularly in AI, digital health, and automation are being evaluated based on measurable operating impact, not future potential. M&A strategies are also becoming more selective, favoring platforms and add-ons that strengthen core economics rather than expand complexity.

Key Takeaways

- AI and automation are becoming operational necessities to address workforce constraints and rising costs.

- Capital-disciplined M&A and selective digital investment are reshaping healthcare delivery models.

- Revenue cycle precision and data integrity are increasingly core margin drivers.

- Regulatory and reimbursement complexity is pushing leaders toward proactive audit and compliance readiness.

- Personalized care and health equity initiatives are evolving alongside value-based reimbursement models.

Patient-Centered Care as an Operational Imperative

Why It Matters

Rising costs, workforce shortages, and aging populations are placing sustained pressure on healthcare delivery models. At the same time, patient satisfaction and access are increasingly tied to financial performance, reimbursement outcomes, and organizational reputation.

Patients now expect transparency, convenience, and digital engagement as standard components of care. Organizations that fail to meet these expectations face higher attrition, delayed care, and revenue leakage—particularly as payers and regulators place greater emphasis on experience and outcomes.

Key Focus Areas

- Inflation and workforce burnout continue to strain operating budgets.

- Expansion through lower-acuity and post-acute care will be a driver for growth in 2026 to combat cost pressures and the aging population.

- Aging populations are driving demand for chronic and long-term care services.

- Approximately 62% of patients report delaying care due to cost or complexity, reinforcing the need for simplified billing and engagement strategies.

- Organizations offering digital scheduling and real-time communication are seeing stronger patient retention and improved outcomes.

What We’re Seeing Across the Healthcare Market

Healthcare organizations are taking a more proactive approach to readiness — addressing tax structure, financial reporting, compliance, and operational visibility earlier in the lifecycle rather than waiting until a transaction or inflection point is imminent.

In conversations with private owners and private equity–backed platforms, leadership teams are focused on building sustainable margins, defensible reimbursement models, and data environments that support real decision-making — not just system adoption.

Many organizations are reassessing how entity structure, tax planning, and long-term strategy align with future growth paths, whether that includes acquisitions, recapitalization, or continued independent operation.

Managing Regulatory, Tax, and Reimbursement Complexity

Why It Matters

From Medicaid reforms to Medicare Advantage scrutiny, 2026 will be a year of heightened regulatory and reimbursement complexity. Providers must manage financial exposure while maintaining compliance across increasingly fragmented payer and reporting environments.

With Medicare Advantage growth and intensified payer audits, coding accuracy has become a core margin driver. Documentation gaps and unsupported diagnoses create recoupment and deal-risk exposure. Proactive coding compliance is now enterprise value protection.

Legislative changes and enforcement trends are prompting healthcare leaders to reassess contract structures, documentation practices, and risk-sharing arrangements—particularly for organizations operating across multiple entities or states.

As AI becomes embedded in clinical workflows, billing, and utilization management, buyers, lenders, and regulators will increasingly evaluate how these systems are governed. Poorly controlled AI models create audit risk, payer disputes, and valuation discounts in transactions. Organizations that can demonstrate strong data integrity, documentation, and AI governance will command higher confidence and stronger multiples.

Key Focus Areas

- The expiration of the ACA’s enhanced premium tax credits at the end of 2025 is expected to raise net premium payments for many Marketplace enrollees in 2026, increasing affordability stress and potentially impacting enrollment and risk mix.

- Medicare Advantage enrollment continues to expand, bringing increased audit scrutiny.

- Payer audits and reimbursement challenges are becoming more frequent and complex.

- Litigation exposure and “nuclear verdicts” are elevating enterprise risk considerations.

AI, Digital Infrastructure, and Data as an Operating System

By: Jon Hilton, Justin Conant

AI Is Now a Balance-Sheet Asset — and a Liability

In 2026, AI and digital health are no longer just technology initiatives.

They are enterprise-value decisions.

Across the healthcare industry, organizations are investing heavily in AI across revenue cycle, diagnostics, population health, and clinical operations. Yet many still lack clear governance, ROI discipline, and auditability around how these systems operate.

That gap has created a new category of enterprise exposure—one that now sits alongside clinical risk, financial risk, and regulatory risk.

At LBMC, we are seeing a clear shift:

AI models and data dependencies are increasingly surfacing in audits, payer discussions, and transaction due diligence—not just IT or innovation committees.

When an organization cannot clearly explain:

- where its data originated

- how an AI model reached its conclusions

- whether outputs are biased, reproducible, or governed

It becomes harder to defend:

- coding accuracy

- reimbursement positions

- quality and risk scores

- and, ultimately, enterprise valuation

Why This Matters to CEOs, CFOs, and CIOs

AI is already touching the money.

- Imaging AI can influence diagnosis codes and medical necessity determinations

- Population-health algorithms affect risk adjustment and payer reimbursement

- Predictive models inform staffing, utilization, and patient throughput

When these systems are opaque, poorly governed, or weakly integrated, the downstream impact can include:

- potential charge leakage

- potential payer clawbacks

- heightened audit exposure

- valuation pressure in transactions

This is why, in 2026, AI governance is becoming as critical as financial controls.

EHRs + AI = Cash-Flow Infrastructure. AI cannot outperform the data it runs on. Disconnected EHRs, inconsistent documentation, and poorly governed AI implementations are often why:

- system go-lives trigger coding delays

- revenue cycles stall

- margins erode for extended periods

In today’s healthcare economy, EHR and AI implementations are cash-flow events—not just IT projects.

Organizations that prioritize data governance, interoperability, and model integrity are better positioned to shorten revenue disruption and accelerate stabilization. Those that don’t often absorb the cost through prolonged margin pressure.

The New Rule of Healthcare AI

The winners in 2026 will not be the organizations that deploy the most AI.

They will be the ones that can demonstrate:

- clean, governed data

- transparent and explainable models

- defensible outputs

- and financially sound results

Because in healthcare, trust is not philosophical. It is reimbursed.

Preparing for Value-Based Care Execution

Why It Matters

As CMS and payers continue to push value-based care models, providers must realign financial structures, data capabilities, and care coordination strategies. Shifting from volume-based reimbursement to outcomes-focused models places new demands on infrastructure and workforce readiness.

VBC Requires a New Revenue Engine

Value-based care cannot scale on fee-for-service revenue cycle infrastructure. Without accurate coding, contract modeling, and real-time financial visibility, risk-based models underperform. In 2026, VBC success depends as much on RCM modernization as on clinical programs.

Organizations that lack reliable data, care coordination tools, or performance visibility face increased risk under value-based arrangements—particularly as margins tighten.

Key Focus Areas

- Risk stratification and predictive analytics are becoming essential capabilities.

- Integrated population health tools are reducing readmissions and emergency utilization.

- Chronic disease management is emerging as a key differentiator in aging populations.

Workforce Transformation and New Operating Models

Why It Matters

Persistent shortages across clinical and non-clinical roles are forcing healthcare organizations to rethink staffing models. Burnout and turnover continue to affect care quality, operational efficiency, and patient satisfaction.

To remain viable, organizations are adopting hybrid staffing models, automation, and outsourcing—particularly across administrative functions.

Key Focus Areas

- A national shortage of critical healthcare workers is projected through 2028.

- Non-clinical roles such as billing, scheduling, and compliance are increasingly automated or outsourced.

- Remote and hybrid models are reshaping workforce expectations and skill requirements.

Data Integrity and Cybersecurity as Enterprise Risk

“Data-driven decision-making only works if leaders can trust the data and protect it,” said Van Steel, LBMC healthcare expert. “With healthcare continuing to face the highest average cost of a data breach — exceeding $10 million — cybersecurity has become foundational to growth, not just compliance.”

In 2026, AI, digital health, and value-based care are no longer experimental. They are operational and financial decisions with regulatory, reimbursement, and enterprise-value consequences. The healthcare organizations that win will not be those that adopt the most technology, but those that govern, measure, and execute it with discipline.

Executing With Intent in 2026

The defining challenge for healthcare leaders in 2026 is not whether change is coming; it is whether their organizations are structurally prepared to execute through it.

As regulators become more active, patients empowered, and operating environments more complex; success will depend less on bold vision and more on disciplined follow-through. Healthcare leaders are moving earlier, planning more deliberately, and demanding greater accountability from systems, partners, and data.

AI, digital health, and value-based care are no longer experimental. They are operational decisions with financial, regulatory, and reputational consequences.

With a national healthcare practice serving privately owned, nonprofit, and private equity–backed organizations, LBMC brings integrated audit, tax, advisory, data, and transaction expertise to support healthcare leaders before, during, and after critical business decisions. Our role is not simply to help organizations grow, but to help them grow intentionally, with clarity, control, and confidence.

Because in 2026, the healthcare organizations that lead will not be the ones that chase every trend, but the ones that execute the right strategies exceptionally well.