Home » Advisory & Business Consulting » Client Advisory and Accounting Services » Family Office Services

Family Office Services

Managing your family’s finances comes with complexity, responsibility, and constant decision-making. As wealth grows and life changes, coordinating day-to-day financial activity can quickly pull focus away from family, business, and personal priorities.

LBMC Family Office provides coordinated financial support designed to simplify those responsibilities. Our team works alongside your trusted advisors to manage ongoing financial operations, improve visibility, and provide clarity—so you can spend less time managing details and more time focusing on what matters most.

With decades of experience supporting high-net-worth individuals and families, LBMC offers a flexible, scalable family office model that adapts to your needs today and evolves with you over time.

Is Family Office Support Right for You?

Family office services are no longer limited to ultra-wealthy households. Today, multi-family office models make professional financial coordination accessible to families with varying levels of complexity.

If you’re juggling multiple accounts, properties, advisors, or family obligations — or simply want a clearer picture of your financial life — family office services can provide meaningful relief and structure.

You choose the level of support you need, from foundational bill pay to comprehensive financial coordination.

Let’s Simplify Your Financial Life

Whether you’re managing complex finances, supporting multiple generations, or simply looking for clearer visibility, LBMC Family Office can help you determine the right level of support for your needs.

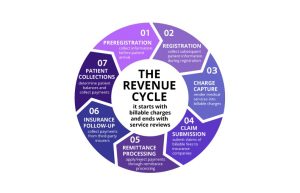

How Family Office Services Work

Our approach is designed to reduce friction and create consistency across your financial life:

- Financial documents and bills are received electronically or by mail

- Payments are reviewed, scheduled, and tracked

- Accounts are reconciled and activity is recorded

- Financial records are securely stored and organized

- Clear, easy-to-read reports are delivered on a regular basis

You gain transparency and control — without managing the day-to-day work.

Core Family Office Services

Bill Pay & Daily Financial Management

At the foundation of family office support is reliable bill pay and expense tracking. We handle incoming bills, process payments, maintain documentation, and reconcile accounts — keeping everything organized and accessible.

This service is especially valuable for busy executives, families with multiple residences, real estate owners, and those supporting aging parents.

Personal Financial Statements

For families who want deeper insight, we prepare and maintain personal financial statements that reflect your full financial picture.

- Updated balance sheets

- Monthly income and expense reporting

- Investment activity tracking

- Credit card and tax-related expense categorization

Because our team works closely with tax professionals, year-end preparation is smoother and more efficient.

Value-Added Financial Support

Family office services extend beyond accounting and reporting. Our team can also support:

- Household payroll and related filings

- Cash flow planning and budgeting

- Coordinated transfers from investment accounts

- Insurance policy reviews and renewal tracking

These services help ensure coverage is appropriate, obligations are met, and nothing falls through the cracks.

On-Demand Financial Coordination

Think of your family office as a central point of contact for financial questions and requests.

Whether you need historical payment details, assistance with loan documentation, or help responding to a tax notice, your account manager already understands your financial structure and can respond quickly.

Get a Clearer Picture of Your Financial Life

From bill pay and reporting to long-term coordination, our family office team helps reduce complexity and improve visibility across your finances.

Family Wealth Planning & Multi-Generational Support

Family office services can play an important role in long-term wealth planning and continuity.

We help families:

- Track distributions and gifting activity

- Coordinate with estate and trust planning professionals

- Support next-generation financial education and planning

- Organize philanthropic initiatives and family foundations

Clear reporting and thoughtful coordination help families plan ahead while maintaining transparency across generations.

Family Care & Property Oversight

Family office support can also assist with life-stage transitions and asset oversight.

- Managing financial activity for aging parents

- Providing clear reporting to multiple family members

- Organizing finances across multiple homes or investment properties

- Producing property-level reporting to support planning and performance review

Having a neutral, experienced team involved can reduce stress and support family harmony.

FEATURED BLOG POSTS

Why Choose LBMC Family Office?

Families choose LBMC for the depth, coordination, and continuity we provide.

- Integrated access to tax, advisory, accounting, and investment expertise

- A dedicated team without the challenges of internal staffing or turnover

- Scalable services that grow with your family’s needs

- Clear communication, consistent processes, and trusted relationships

Our goal is to simplify complexity while protecting what matters most to you.

CLIENT TESTIMONIALS

LBMC Team

Jacqueline Jacquemain

Senior Manager, Wealth Advisory Services and Family Office Practice

Let’s Talk About What You Need

Not sure where to start? That’s okay. Every family’s situation is different.

Request a consultation to discuss your goals, challenges, and priorities. We’ll help you determine whether family office services are a fit — and what level of support makes the most sense for you.