Unlike most other businesses, healthcare providers often deal with multiple parties throughout the billing process, such as patients, third-party insurers, and government programs (such as Medicare and Medicaid). While the interaction and agreements with these parties impact cash collections for services rendered, it’s almost impossible for these providers to be sure how much they will ultimately collect.

Key Takeaways

- Definitions:

- Contractual Allowances: Reductions in billed amounts based on agreements with insurers and government programs.

- Bad Debt Allowances: Estimates of amounts uncollectable from patients, recognized after collection efforts fail.

- Differences and Implications:

- Revenue Impact: Contractual allowances adjust gross revenue at billing, whereas bad debts affect net revenue upon collection failure.

- Tax Considerations: Bad debts are tax-deductible only after being definitively written off.

- Strategic Management:

- Maintain separate financial accounts for clear reporting and compliance.

- Regularly review collection policies to adapt to changing insurance contracts and payer mix.

Healthcare providers generally take into consideration two separate categories when estimating ultimate collections – contractual allowances and bad debt allowances. Because of the unique nature of the healthcare business, these providers need to take special care in accounting for them, lest they run into problems with the IRS.

What is contractual allowance adjustment?

Contractual allowances, also known as contractual adjustments, are the difference between what a healthcare provider bills for the service rendered versus what it will contractually be paid (or should be paid) based on the terms of its contracts with third-party insurers and/or government programs. Often the reimbursement amount is lower than the billed amount.

What is bad debt allowance?

Bad debt allowances typically represent an estimate for the amount a patient or other payer cannot (or will not) pay of its portion of the bill, also known as uncompensated care. Some healthcare providers report bad debt as the difference between what was billed to the patient and the amount the patient paid. The U.S. generally accepted accounting principles that most healthcare providers began using Jan. 1, 2018, dramatically narrowed what hospitals can report as bad debt. The majority of what used to qualify won’t be reported as such moving forward.

How are contractual allowance and bad debt allowance different?

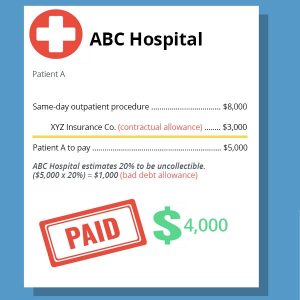

To illustrate contractual allowance and bad debt allowance, assume in this example that ABC Hospital provides a same-day outpatient procedure to Patient A who has healthcare insurance with XYZ Insurance Co. Upon completion of the procedure, ABC Hospital bills XYZ Insurance Co. $8,000 for the value of the services provided to Patient A. Under the terms of the contract/agreement between ABC and XYZ, the agreed-upon amount that should ultimately be reimbursed to ABC Hospital is $5,000. The $3,000 difference represents a contractual allowance. Now assume Patient A is responsible for paying the full $5,000 because she has yet to meet her annual deductible. Based on the historical trends of cash collections from actual patients, ABC Hospital estimates that 20% of such outstanding A/R to be uncollectible. This estimate of $1,000 ($5,000 x 20%) represents a bad debt allowance. While the value of the service provided by ABC Hospital is $8,000, the estimated collection of cash is only $4,000.

As illustrated above, contractual allowances and bad debt allowances are similar in that they represent cash that will likely not be collected. However, they are fundamentally different in that contractual allowances represent adjustments to gross revenue based on true contractual agreements between service providers and insurers/government programs, whereas bad debt allowances are estimates of uncollectible net revenue based on historical patient/payer payment trends.

Tax reporting for contractual allowance and bad debt allowance

Allowances for bad debts are not deductible for tax purposes until the related accounts receivable are written off the taxpayer’s books and records as uncollectible after exhausting collection efforts (both internally and through third-party collection agencies). As a result, the IRS wants bad debt allowances clearly separated in tax returns and lumping them together with contractual allowances may cause the IRS to disallow a deduction for the entire amount.

To ensure proper tax return reporting, providers should make separate line entries for contractual allowances and bad debt allowances when compiling financial information. In arriving at net accounts receivable, the chart of accounts should contain accounts for gross accounts receivables, contractual allowances, and bad debt allowances. In arriving at net patient service revenue, the income statement accounts in the chart of accounts should have accounts for gross patient service revenue, contractual allowances, and bad debt expenses.

LBMC has helped many hospital systems and physician practices with their revenue recognition standards and tax reporting. We are a proven leader in healthcare with significant experience in the industry as evidenced by more than 300 healthcare related organizations ranging from multi-billion dollar organizations to smaller organizations. Learn more about the services we offer our healthcare clients.

Content provided by LBMC professional, Ben Carver.

Ben Carver is a shareholder in the tax practice at LBMC, a premiere Tennessee-based professional services firm.

LBMC tax tips are provided as an informational and educational service for clients and friends of the firm. The communication is high-level and should not be considered as legal or tax advice to take any specific action. Individuals should consult with their personal tax or legal advisors before making any tax or legal-related decisions. In addition, the information and data presented are based on sources believed to be reliable, but we do not guarantee their accuracy or completeness. The information is current as of the date indicated and is subject to change without notice.