Blog

Understanding Tax-Related Identity Theft and Refund Fraud

Tax-related identity theft and refund fraud may be avoided with increased awareness and actions that complement IRS security. Learn more.

Understanding Tax Rates – Marginal vs Effective/Average vs Actual

Key Takeaways Marginal rate affects your next dollar earned, while effective rate reflects the average tax across all your income. Actual tax rate includes the ...

Three Steps to Creating Strong Passwords

This article will give you the confidence to say that you never forget your passwords, they are unique to every site and virtually impossible to ...

What is Nexus and Why You Should Care if Doing Business in Different States?

Key Takeaways Nexus determines your tax obligations in different states—it’s not just about physical presence anymore. Each state has its own rules for when nexus ...

Kerberos Attacks and Mitigations

Kerberos related attacks are some of the favorite attack methodologies for penetration testers. These types of attacks can provide exciting ways to escalate privilege, hide ...

Five Topics to Consider when Outsourcing Accounting Operations

Companies should consider these five topics when determining on if financial outsourcing is the right answer for their company. Click to read article.

“Gophishing” to Boost your Security Awareness Training

Any information security program must consider how users react to phishing campaigns. It is undeniable that constant training helps to defend against deceptive tactics. Many ...

TN Department of Revenue Explains New Sales and Use Tax Refund Law

Beginning October 1, 2021, the Tennessee Department of Revenue will permit taxpayers to seek a refund of sales and use tax directly from the Department ...

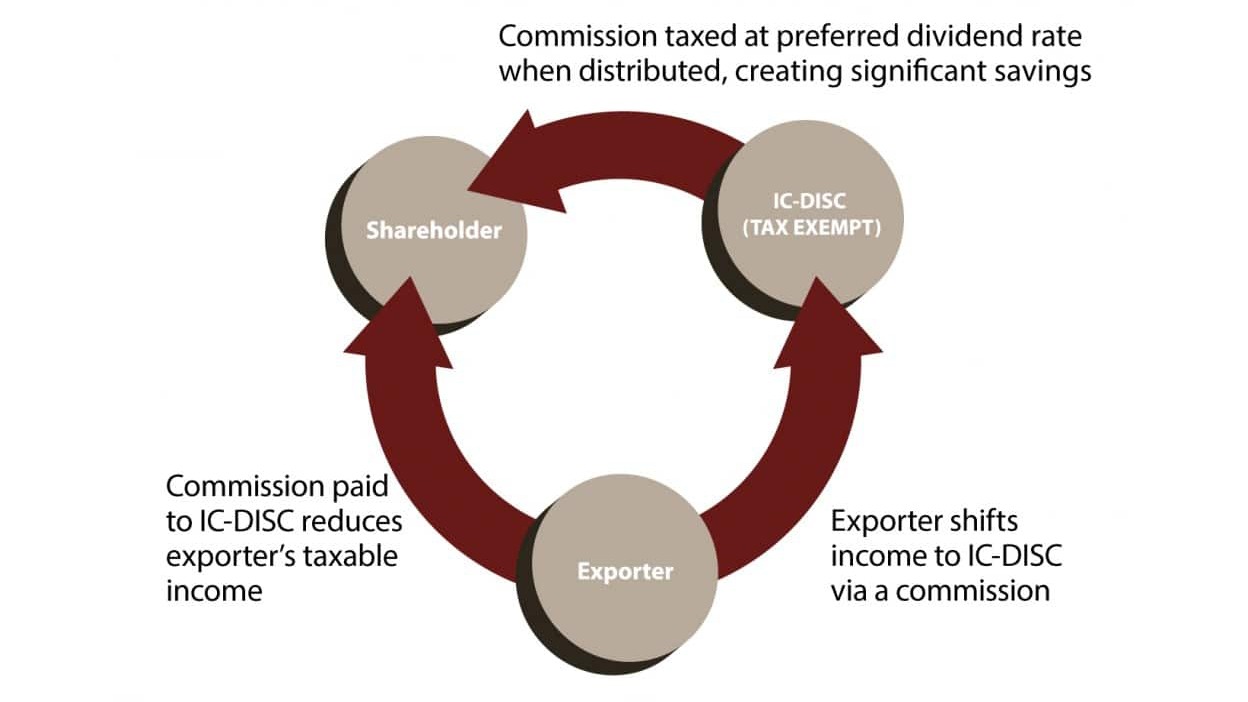

IC-DISC: What is it and how does it work?

An Interest Charge Domestic International Sales Corporation, or IC-DISC, offers a significant federal income tax savings for making or distributing U.S. products for export.

Cybersecurity in the Boardroom

Board members do not need to be cybersecurity experts to play an important role in defining the overall cyber health of their organization. In this ...

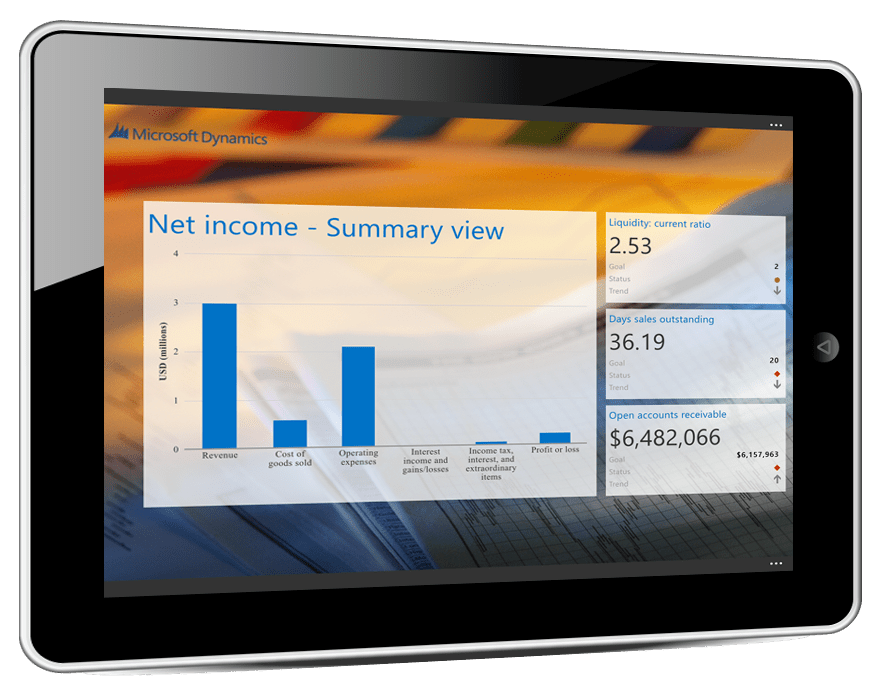

New Lifecycle for Microsoft Dynamics GP – Updates You Need To Know

In October of 2019, Microsoft instituted a new support policy for Dynamics GP. The new Modern Lifecycle replaces the previous Fixed Lifecycle, wherein Microsoft supported the product for a fixed 5 years ...

Understanding Tax Issues Related to Shareholder Loans

This article explains the importance of treating shareholder loan transactions as bona fide loans and charging an "adequate" rate of interest.