Have you been asked to be an estate executor? If so, you may feel both honored and overwhelmed. While it is an honor to be asked to manage a friend’s or loved one’s final affairs, it is also an enormous responsibility. The complexity of the duties required of an executor varies, but essentially an executor is legally responsible for managing the finances of the deceased person. This includes making sure all debts and taxes are paid and distributing any remaining property to the heirs. The role of an executor can be extremely time consuming and stressful. However, there are steps that can be taken now, while your friend or loved one is still living, that can reduce the stress and complications that come with the job.

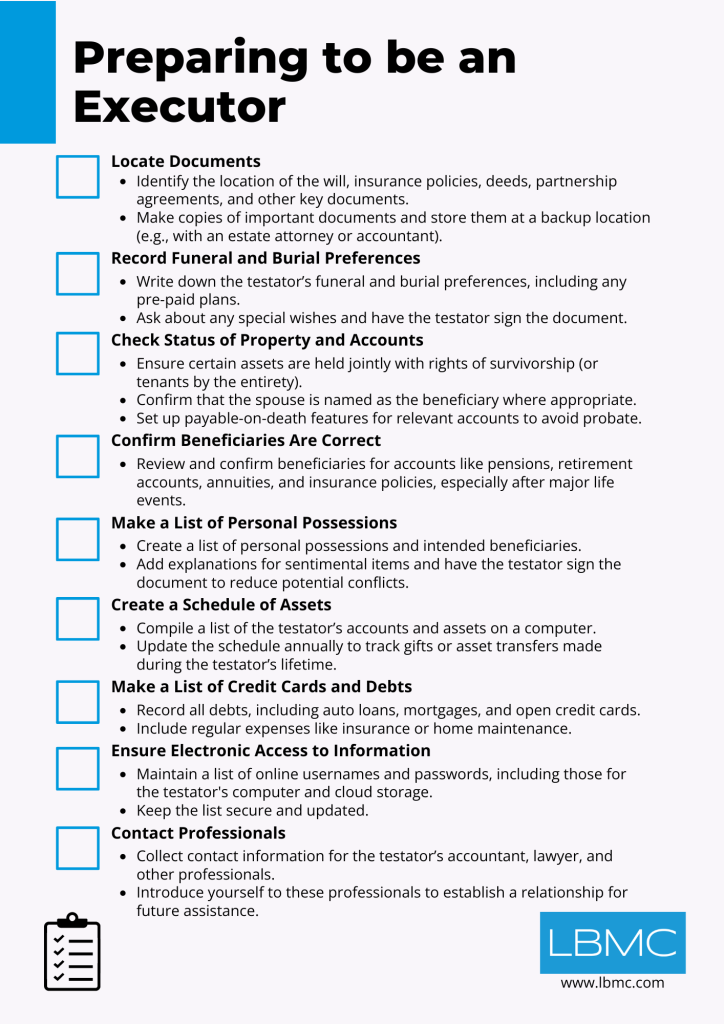

Checklist: Preparing to be an Executor

Locate Documents

Make sure that you know where the will, insurance policies, any deeds, partnership agreements, or other important documents are located. Make copies of all important documents to keep at a back-up location. These copies can be held by the executor or given to the estate attorney or accountant.

Record the preferences of the testator

Write down the testator’s preferences regarding funeral and burial arrangements including details of any pre-paid burial plans. Ask the testator if he or she has any special wishes. Once these preferences are recorded, have the testator sign the document.

Check status of property and accounts

In most cases, the testator will want certain assets to go directly to his or her spouse. This is most easily accomplished by ensuring that all such accounts and properties are held jointly with rights of survivorship (or as tenants by the entireties) in the names of both the testator and his or her spouse, or in the alternative that the spouse is named as the beneficiary of the account. The same holds true if the testator is a partner in a business entity. Many accounts such as CD accounts, bank savings and brokerage accounts can be set up with a payableon-death feature. This allows the testator to specify who the account should be distributed to and keep the account from going through probate.

Confirm beneficiaries are correct

The testator should confirm that all beneficiaries listed on accounts such as pensions, retirement accounts, annuities and insurance policies are correct. This should be reviewed after any major lifechanging event such as marriage, divorce, birth of a child, etc.

Make a list of personal possessions

One of the hardest jobs for executors is determining the value of personal possessions that may not have a high level of financial value, but do have a great deal of sentimental value. While the testator is living, make a list of personal possessions and preferred beneficiaries. You may also write an explanation next to the possession to explain in the testator’s words why a certain person has been given a particular possession. Then have the testator sign the document. This will eliminate some of the stress that accompanies the dispersal of emotionally significant personal possessions. If the value of the personal possessions is significant or if there is a likelihood of a disagreement, the testator can spell out in his or her Will exactly who receives what.

Create a schedule of assets

On a computer, create a schedule of the testator’s accounts and assets. Update this schedule on an annual basis so that you will have an up to date record of all accounts and assets when it is time to execute the will. The update should also track gifts that are given, as many people begin dispersing personal items as they age. This annual update can save you time after the testator’s death looking for assets which may have already been given away.

Make a list of credit cards and debts

Include everything such as auto loans, mortgages, open credit cards, and any other debts. List any bank drafts or expenses which need to be paid regularly such as insurance, home maintenance, etc.

Electronic access to information

Make a list of online usernames and passwords including passwords needed to log onto the personal computer, cloud based storage or other devices. Keep the list up to date and in a secure place, like a home safe. List where to find important files such as tax returns, Quicken reports or spreadsheets used to track financial information.

The executor of an estate can have the decedent’s mail forwarded to the executor’s address. In the past, that would provide bank and brokerage statements, tax documents, bills, etc. which would help the executor be sure they knew about the assets owned and debts. However, now that statements are increasingly only online, relying only on paper could cause the executor to not discover all accounts or bills. Having access to email accounts is key to collecting digital asset information. Be aware that federal computer privacy law applies. There is a distinction under the law between accessing the content and accessing the record of communication. This could be thought of as the difference between opening the envelope and reading the letter (content) or only seeing the outside of the envelope.

Contact the professionals

It is important to have contact information for, and preferably be introduced to, the testator’s accountant, lawyer, and any other professionals associated with the testator. These professionals will likely have an understanding of the testator’s financial affairs and can provide crucial assistance during the executor preparation process. Although an executor is not legally required to be a financial expert, the handling of another’s property does require a certain degree of financial and legal knowledge. If there is a loss to the beneficiaries resulting from the mismanagement of funds, an executor can be held personally liable. You may decide to hire an accountant or lawyer to help you execute the will and close the estate or to do everything.

Your loved one has entrusted you with winding up their earthly affairs. This fiduciary duty requires you to act with good faith and honesty on their behalf. The size and complexity of the estate can make your job as an executor easy or very challenging. Taking the steps outlined above while the testator is still alive can make your job less stressful.

LBMC tax tips are provided as an informational and educational service for clients and friends of the firm. The communication is high-level and should not be considered as legal or tax advice to take any specific action. Individuals should consult with their personal tax or legal advisors before making any tax or legal-related decisions. In addition, the information and data presented are based on sources believed to be reliable, but we do not guarantee their accuracy or completeness. The information is current as of the date indicated and is subject to change without notice.